Introduction

The construction sector in Ireland continues to face a number of economic and geo-political pressures and despite this, the outlook remains positive with forecasts for the sector to grow overall this year.

Our latest construction update puts the spotlight on three key developments facing the sector at present and looks at:

- Professional indemnity insurance update;

- Developer focussed Croí Cónaithe Scheme; and

- Collateral warranties – a construction contract or no?

1. Professional indemnity insurance update

Our September 2021 edition noted that the professional indemnity insurance (“PII”) market in Ireland had considerably contracted over the last few years. Unfortunately, the PII market has constricted further (in particular in relation to cladding and roofing) due to the ongoing aftermath of Grenfell and the withdrawal of a number of insurers from the market.

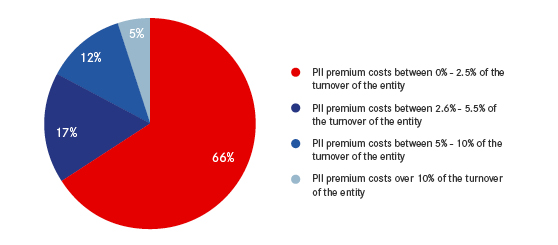

A survey of contractors / sub-contractors carried out this year by the Construction Leadership Council in the UK ("CLC Survey")[1], interestingly investigated the cost of PII premiums at last renewal as a percentage of the turnover of the survey participants (where the focus of the workload of the participants was not high-rise residential work) and found that in respect of 5% of the participants to the survey, PII premium costs equated to over 10% of the turnover:

From a private sector contract perspective, parties are adapting to these issues with commercially minded negotiations and contracts will now generally reference PII being available on "commercially reasonable rates", a term which should ideally be defined under each individual contract. Furthermore, it is becoming increasingly important for parties to require that "next best insurance" is procured, in the event that the initial PII cover is not available at the prescribed "commercially reasonable rates".

From a public sector contract perspective, in an effort to recognise the difficulties now facing contractors and construction professionals in procuring the necessary PII cover, revised guidelines for public works projects procured under the Capital Works Management Framework ("CWMF") were published earlier this year. A range of amendments have been undertaken to the standard procurement templates in the CWMF, which amendments are all designed around ensuring that contractors and construction professionals are maintaining the next best level of insurance (based on the EU / UK markets) and putting parameters around the concept of commercially reasonable rates.

Continuous monitoring of the market, in other words, is the obligation in a nutshell, and agreeing to always have the best insurance on the market, provided that it is available at reasonable rates. On a separate note, the government has introduced a scheme this year pursuant to which the state will cover up to 70% of the additional costs arising on public sector contracts due to inflation.

2. Developer focussed Croí Cónaithe Scheme

The current viability gap between the cost of building apartments and the market sale price has been worsened by Brexit, COVID-19 and the current situation in Ukraine. In an effort to somewhat bridge that gap, the Government has responded with the Croí Cónaithe (Cities) Scheme which aims to reduce costs for home buyers and increases housing supply in cities.

The key components of the scheme are as follows:

- it applies to apartment blocks (at least 4 stories high), located in Dublin, Cork, Galway, Limerick or Waterford, and close to public transport;

- it is developer focused (as opposed to end user focused);

- it relates to apartments for sale to owner-occupier households only; and

- complete planning permission must be obtained by the relevant developer before applications will be accepted.

The scheme will be managed and administered by The Housing Agency (on behalf of the Department of Housing, Local Government and Heritage) who will assess eligibility and carry out detailed due diligence and an open book assessment on eligible proposals. The up take to this scheme and the effect of this scheme on the apartment sales market remains to be seen.

3. Collateral warranties – a construction contract or no?

This is a question that many stakeholders in the construction industry have asked over the years and now, in the UK at least, there is some clarity on the point, albeit in specific and limited circumstances only. On 21 June 2022 the Court of Appeal in England reversed the decision in Abbey Healthcare (Mill Hill) Limited v Simply Construct (UK) LLP [2022] EWCA CIV 823 ("Abbey"), holding that the collateral warranty in that case constituted a construction contract with a statutory right to adjudication.

The relevant UK legislation for the purposes of this case is the Housing Grants, Construction and Regeneration Act 1996 (the "Act"). The Act provides that parties to a "construction contract" have the implied right to refer a dispute to adjudication at any time, even in the absence of an express adjudication clause. Section 104 of the Act defines a "construction contract" broadly however, and there has been uncertainty about whether a collateral warranty could ever constitute a construction contract for the purposes of this Section.

In Abbey, the Court of Appeal found that a collateral warranty could amount to a construction contract, but this would depend on the wording of the warranty in each case. In Abbey, the contractor warrants in the relevant collateral warranty that it "has performed and will continue to perform diligently its obligations under the contract". On the basis of that wording, and in particular the words "will continue to perform", the Court found that the obligations arising under that warranty were "inextricably linked" to the carrying out of the relevant construction operations. If Simply Construct had failed to complete the construction operations, they would have been in breach of the warranty.

The key issue for the Court was whether the warranty recognised only the existence of the contractor's obligation to perform the construction operations under the building contract (this would be more typical wording) or whether the warranty comprised separate actionable obligations on the part of the warrantor. On the basis that there were separate actionable obligations created under the Abbey warranty, the Court held that it constituted a construction contract for the purposes of the Act.

Key takeaway

Although there has been no decision from the Irish courts yet on this point and the finding in the Abbey case very much turns on its own facts, parties should consider when drafting a collateral warranty if the intention is that it should constitute a construction contract for the purposes of the Construction Contracts Act 2013, which is the relevant legislation operable in this jurisdiction. If not, wording which could create any separate actionable obligations on behalf of the warrantor therein should be avoided.

For further information, please contact any member of our Construction & Engineering team. Matheson has one of the largest and most experienced construction & engineering law practices in Ireland. Our growing team of lawyers operating out of our Dublin and Cork offices are equipped to advise you on the full range of legal issues across the construction industry in Ireland.

[1] Findings as per the CLC Survey which can be accessed in full here.